Stay ahead of the curve with our expert insights on Statutory Compliance! Whether you’re a business owner, HR professional, or compliance officer, navigating the maze of legal regulations can be daunting. Our collection of blogs breaks down complex topics into simple, actionable advice. From understanding the latest laws to practical tips for staying compliant, we’ve got you covered every step of the way.

Compliance doesn’t have to be a headache – it can be a strategic advantage! Our blogs not only highlight the must-know rules but also reveal how efficient compliance practices can boost your business operations. Dive in and discover how to streamline your processes, minimize risk, and keep your organization on the right side of the law.

Have you ever stared at a salary slip and wondered what all the numbers actually mean? For many employees, that slip feels like a secret code, not a source of financial clarity.

For many years, work in India came with confusion. Employees worked hard but often didn’t know their rights. Wages were unclear. Benefits depended on job titles. Safety rules existed, yet many felt unprotected. .

India’s labour law framework is no longer in a transition phase—it is entering a stage of active and visible enforcement. What businesses discussed for years as “upcoming reforms” is now shaping everyday operations across industries.

Expanding into the Indian market? Great move! With its booming economy and immense potential, India offers businesses incredible opportunities. But—and it’s a big “but”—compliance with Indian labour laws can feel like trying to solve a Rubik’s Cube in the dark.

Statutory compliance is like the lifeline of every business—essential yet intricate. Whether you’re a startup or an established corporation, navigating the maze of Indian statutory requirements can feel overwhelming.

Managing Tax Deducted at Source (TDS) compliance for employee salaries is a critical aspect of payroll management for every organization in India. It not only ensures adherence to tax laws but also builds trust and transparency within the workforce.

Labour laws form the backbone of fair workplace practices and employee rights in India. However, non-compliance with these laws can lead to severe consequences for businesses, including financial losses, reputational damage, and legal penalties.

In today’s fast-paced business world, managing Statutory Compliance is more than just a legal obligation—it’s a crucial element for ensuring the smooth functioning of your company.

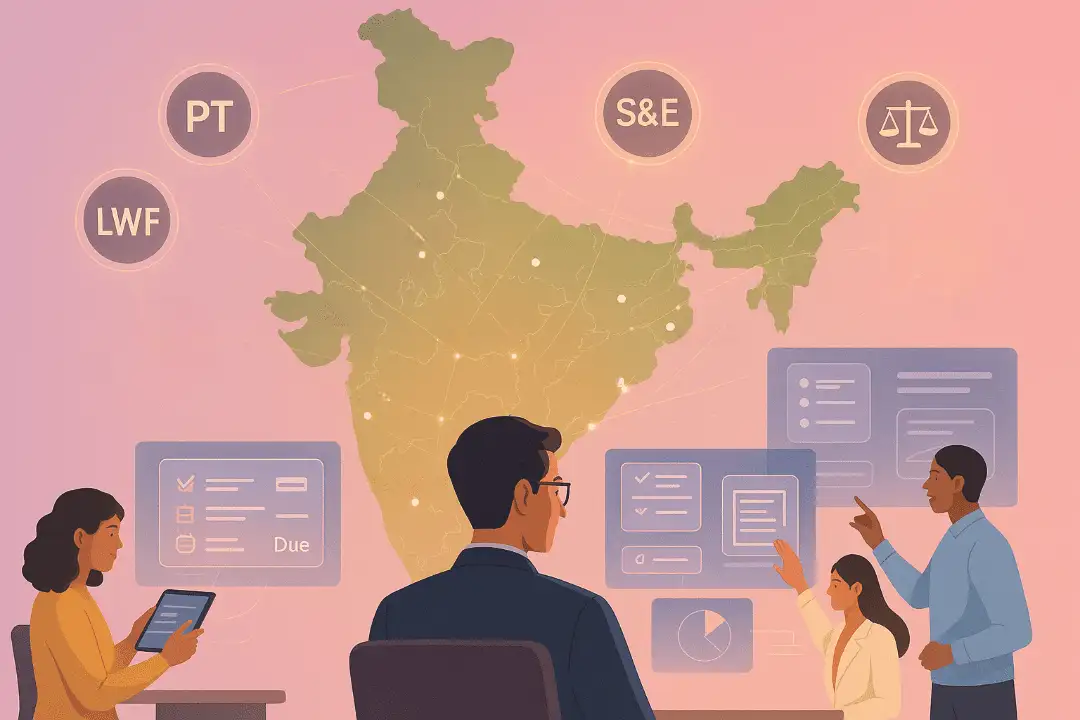

When it comes to managing payroll and employee-related taxes, Professional Tax (PT) is an important compliance requirement for businesses in India.

When it comes to statutory compliance in India, Provident Fund (PF) compliance is a cornerstone. Whether you’re running a small startup or managing a large enterprise, ensuring compliance with PF regulations is not just a legal obligation—it’s a way to show your employees you care about their future.

Employee welfare isn’t just a nice-to-have—it’s a legal necessity. In India, Employee State Insurance (ESIC) is one such critical welfare scheme that provides medical, financial, and social security benefits to employees and their dependents.

As of 2024, Labour Welfare Fund (LWF) continues to play a significant role in improving employee welfare in India. This statutory contribution ensures funding for initiatives like housing, healthcare, education, and other support services for workers.

In any workplace, clarity is key. When employees know what’s expected of them, how day-to-day situations are handled, and where boundaries lie, the workplace becomes more efficient and less stressful.

Running a business comes with responsibilities—one of the biggest is understanding the rules that protect both your company and your employees. HR regulations aren’t just legal requirements.

India’s employment laws don’t just exist to complicate payroll — they’re designed to protect employees and encourage fair practices. But even with the best intentions, companies can slip up by missing one crucial detail: mandatory employee benefits.

When it comes to running a business, HR compliance often doesn’t make the headlines—until something goes wrong. It’s not just about following rules; it’s about building a safe, transparent, and lawful workplace.

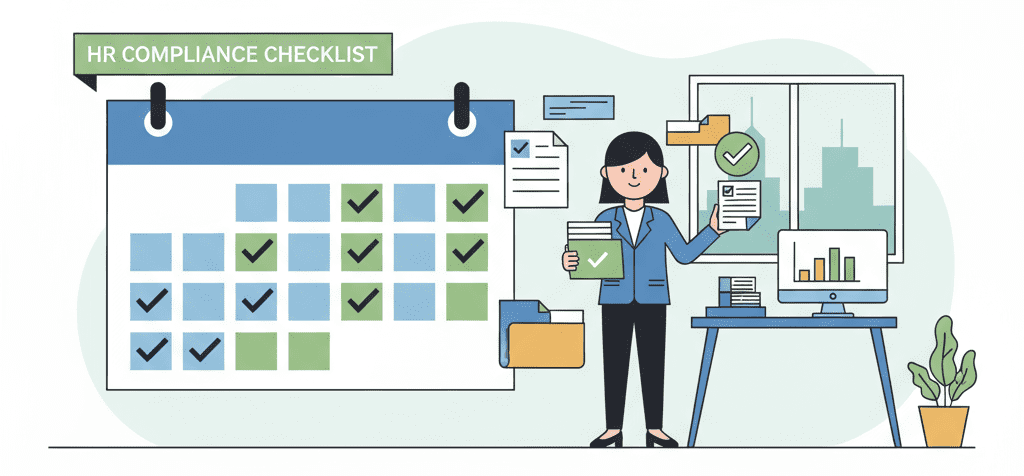

Let’s face it—HR compliance isn’t something you can leave on autopilot. With laws changing often and inspections getting stricter, generating monthly HR compliance reports isn’t just a formality anymore.

Expanding an IT startup is exciting—but overlooking HR compliance can slow you down quickly. Many early-stage companies jump straight into product development and hiring, often assuming HR compliance will “figure itself out.”

Statutory compliance in HR means following all labour laws and regulations that protect employees’ rights. This blog explains the basics, key laws in India, and why every employer must stay compliant.

Many people confuse statutory compliance with labour law compliance, but they aren’t the same. This blog breaks down the differences, scope, and focus of both, helping employers clearly understand what each covers.

Staying compliant with HR laws in 2025–2026 is critical for every business. This blog provides a simple, step-by-step statutory compliance checklist covering PF, ESI, gratuity, bonus, maternity benefits, and upcoming labour code changes to help startups, SMEs, and enterprises avoid penalties and stay future-ready.

This guide compiles every major statutory filing and deadline Indian organisations must follow in 2026. It simplifies PF, ESI, TDS, GST, LWF, and labour-law compliance into a clear monthly checklist, making it easier for businesses to stay organised and avoid penalties throughout the year.

This blog explains how compliance requirements change when companies expand to new locations in India. It covers state-specific registrations, minimum wages, labour laws, and local filings — offering a practical roadmap to staying legally compliant while scaling into new regions.

This article breaks down how to design a balanced and legally sound salary structure. It explains how PF, ESI, and labour codes impact salary components, and provides clear guidance on building transparent, compliant compensation models that protect both employees and employers.

1003-04, 10th floor G-Square Business Park, Jawahar Road, Opposite Railway Station, above Kalyan Jewellers, Ghatkopar East, Mumbai – 400077

601 to 603 Aries Galleria, Vasana Road, Vadodara – 390015 Gujarat, India

Contact TMS:

+91-224-149-8942

+91-224-896-7640

For General Queries:

[email protected]

For Sales:

For Jobs:

[email protected]

Team Management Services. All Rights Reserved | Privacy Policy | Terms & Conditions